29102013 A Muslim is not allowed to benefit from lending money or receiving money from someone. 20102018 A bank prohibited from paying interest might seem an unlikely choice for savers.

Islamic Banking Or Islamic Finance Or Sharia Compliant Finance Is Banking Or Financing Activity That Complies With Sharia Islami Islamic Bank Investing Islam

Islamic Banking Or Islamic Finance Or Sharia Compliant Finance Is Banking Or Financing Activity That Complies With Sharia Islami Islamic Bank Investing Islam

Instead they invest in companies and share the profits with their depositors.

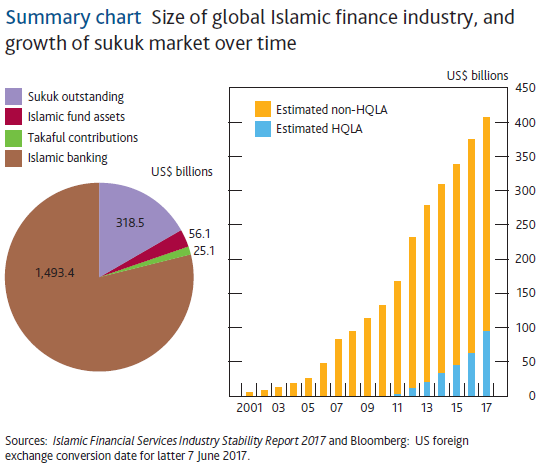

Do islamic banks pay interest. Banks are by far the biggest players in Islamic finance some of them are exclusively Islamic while others offer sharia-compliant products but remain mostly conventional. They dont deal in Interest at all based on their framework. Beginning 1983 banking business in Malaysia had witnessed a new development of Islamic banking where interest riba was banned for the first time in the nation when the first Islamic bank Bank Islam Malaysia Berhad BIMB was introducedOne of the golden features of the Islamic banking.

Any predetermined addition to the amount that is to be paid is considered interest. I dont have any proofs Why would i even think of it. Having said that Yes Islamic Banks make money via Mudharabah Wadiah Musharakah Murabahah and Ijarah and other services.

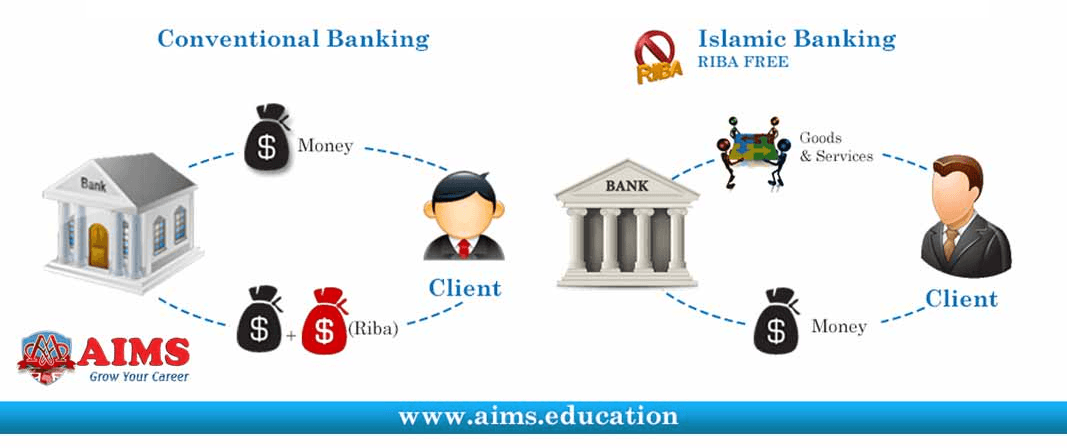

18042016 Islamic banks do not pay interest to depositors or charge interest to borrowers. So taking out. 03112019 That means Muslims have to work for money to attach its value.

Islamic banking products must not charge or pay interest - they make money through a system of leasing and investing Islamic bank accounts are open to non-Muslims Members of other religions may choose to use a bank or mutual society suited to their principles. Instead Islamic banks. Also called Riba in Arabic it means an unlawful increase in the amount of money or commodity to be paid back by a borrower to a lender.

Some banks that currently offer them include. So we are creating a new type of account for such banks that doesnt pay interest. By Dr Hanudin Amin.

It is not permissible to make use of this interest and the customer must repent to Allaah from depositing his money in riba-based banks. Sharia-compliant banks have been experiencing a period of rapid growth especially in the non-Muslim-majority world. The Scholars of the Standing Committee for Issuing Fatwas said.

The choice is more limited than it used to be but there are Sharia compliant bank accounts available in the UK. Depositors also share in the banks profits which are determined in accordance with an agreed ratio. But rather than paying an annual equivalent rate of interest on savings - like most banks do - Islamic banks pay an Expected Profit Rate EPR so what savers earn depends on the profit the bank makes.

But Islamic Banks may make money via Illegal andor Haraam businesses. 02042021 Many of the products offered by Islamic financial institutions are comparable to Western or conventional finance even though interest and speculation are forbidden. In order to do so there are shariah boards which consist of Islamic scholars who are qualified to give opinions on Islamic financial products.

In fact the UK is the leading centre for Islamic finance in the west according to a report on Islamic finance trends by TheCityUK with five fully Sharia-compliant banks licensed here. Islamic banks make a profit through equity participation which requires a borrower to give the bank a share in their profits rather than paying interest. Islamic banks are strictly forbidden to charge interest.

Islamic banks are not supposed to pay interests they pay profits at a fixed - rate for a period of time. When Islamic bank lend money to you they tend to charge you at a fixed pre-calculated settlements and if you defer a payment they will give you two months notice before they open the. Islamic bank accounts work on the principle of Qard an ethical interest-free loan.

Any money in your account is lent to the bank interest free until you withdraw it. Simply lending and borrowing money doesnt count as work. The practice is banned under sharia.

07012017 Why interest charges are forbidden in Islamic banking. We noticed Islamic banks were unable to use these accounts because we paid interest on them. Islamic banks must comply with a variety of principles besides not charging interest such as ensuring the products offered to clients are halal and shariah compliant.

7 In financial endeavors Sharia law mandates risk sharing and disallows speculation or gharar. The main principles of Islamic banking include sharing risk prohibiting monopoly making fair transactions ethical investing and most notably proscribing interest or riba. 8 This encourages many Islamic banks to form a partnership relationship or joint venture with their customers.

Consequently the banks their depositors and their borrowers also share the risks of the business. The interest which the banks pay to depositors on the money that they deposit in them is regarded as riba usury. Islamic banks dont charge interest but instead participate in the yield that results in the use of funds.

Investment financing and trade financing are done on a PLS basis. Instead the concept of profit and loss sharing comes into play. This means that earning interest riba is not allowed whether you are an individual or a bank.

That means Islamic banks in the UK will be able to use some of the same support we give to other banks. While not every Muslim believes that charging interest is wrong it is part of Islamic or Sharia law and Islamic finance where no interest is charged is practised in a growing number of banks around the world.

History Of Islamic Banking And Finance Aims Uk Youtube

History Of Islamic Banking And Finance Aims Uk Youtube

7 Major Principles Of Islamic Banking And Finance Aims Uk Youtube

7 Major Principles Of Islamic Banking And Finance Aims Uk Youtube

Institute Of Islamic Banking And Finance Best Islamic Finance Training For More Details And References Please Goto Https Twitter Finance Banking Islam

Institute Of Islamic Banking And Finance Best Islamic Finance Training For More Details And References Please Goto Https Twitter Finance Banking Islam

What Is Islamic Banking And How Does Islamic Banking Work Vblog Aims Uk Youtube

What Is Islamic Banking And How Does Islamic Banking Work Vblog Aims Uk Youtube

What Is Islamic Banking And How Does Islamic Banking Work Vblog Aims Uk Youtube

What Is Islamic Banking And How Does Islamic Banking Work Vblog Aims Uk Youtube

What Is Islamic Finance And How Does It Work Global Finance Magazine

What Is Islamic Finance And How Does It Work Global Finance Magazine

How Does Islamic Banking Work Edology

How Does Islamic Banking Work Edology

Why Is Usury Prohibited In Islam About Islam Islam The Borrowers Global Economy

Why Is Usury Prohibited In Islam About Islam Islam The Borrowers Global Economy

Islamic Vs Conventional Banks In The Gcc Blogs Televisory

Islamic Vs Conventional Banks In The Gcc Blogs Televisory

Taking Loans From Islamic Banks Islamic Bank Islam Bank Lending

Taking Loans From Islamic Banks Islamic Bank Islam Bank Lending

These Are The Top 9 Countries For Islamic Finance World Economic Forum

These Are The Top 9 Countries For Islamic Finance World Economic Forum

Pdf Modern Islamic Banking Products And Processes In Practice The Wiley Finance Series Online Book By Natalie Schoon Islamic Bank Banking Islam

Pdf Modern Islamic Banking Products And Processes In Practice The Wiley Finance Series Online Book By Natalie Schoon Islamic Bank Banking Islam

Diploma In Islamic Banking And Finance Aims Uk Finance Islam Banking

Diploma In Islamic Banking And Finance Aims Uk Finance Islam Banking

Highlights Of Malaysia S Islamic Banking System Http Malaysiafinancialservices Wordpress Com 2013 07 26 What Is Islamic Banking Humor Islamic Bank Banking

Highlights Of Malaysia S Islamic Banking System Http Malaysiafinancialservices Wordpress Com 2013 07 26 What Is Islamic Banking Humor Islamic Bank Banking

Islamic Banks And Central Banking Bank Of England

Islamic Banks And Central Banking Bank Of England

Difference Between Islamic Banking And Conventional Banking Aims Uk

Difference Between Islamic Banking And Conventional Banking Aims Uk